Indian Tyre Industry – Driving on the Auto Sector Growth

Indian Tyre Industry – Driving on the Auto Sector Growth

The Indian Tyre Industry is an integral part of the Auto sector and its fortunes are interdependent on those of the Automobile players.

For the year 2010-11, the industry has clocked a turnover of almost Rs. 30,000 Cr. of which 90-95% has come from the domestic market. While there are around 40 tire manufacturers in India, the top 10 tire players account for around 90-95% of the total tire production in India.

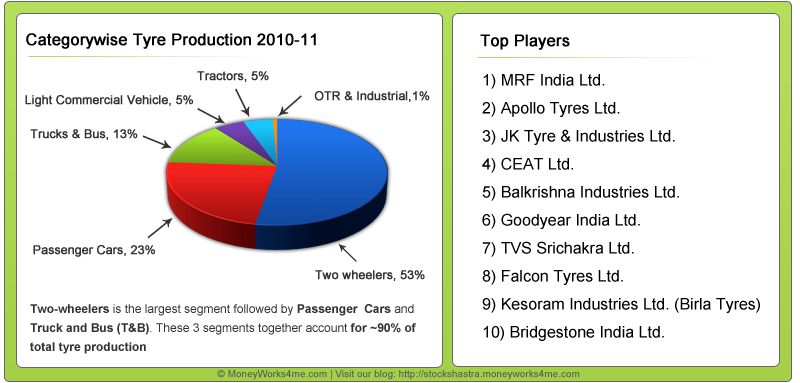

The tire industry can be divided into 6 categories based on the different auto segments that they are manufactured for. The table given below gives the category-wise production for 2010-11.

On a volume basis, the 3 major segments of the tire industry are Two-wheelers, Passenger Cars, and Trucks and Bus (T&B).

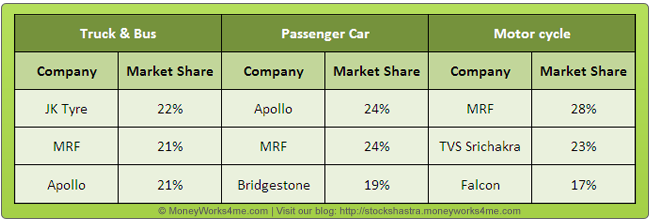

The table given below gives the list of the top 3 players (considering their market share as per volumes) in these 3 major segments.

As seen in the above table, the T&B (Truck & Bus) segment is highly competitive with the top 3 players having market shares very close to each other.

JK Tyre is slightly ahead with a 22% market share. Apollo Tyres is the market leader in the Passenger Car segment with 24%. MRF which has a good presence in all the segments is the leader in Motor Cycle with a 28% share.

So, how does the Indian tire industry work?

Here is the analysis…

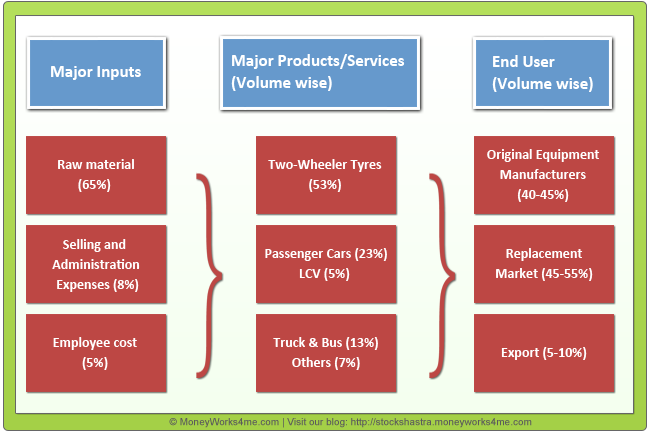

The working of the Tyre industry has been explained pictorially below:

Inputs:

Inputs:

The industry is high raw material (RM) intensive. Raw material costs account for 65-70% of the total production cost of tires.

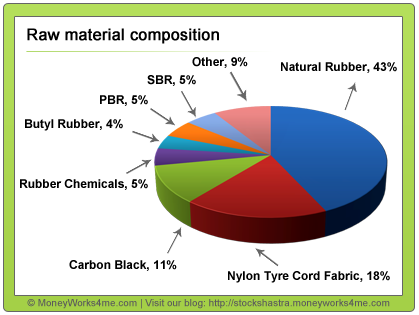

The pie chart gives the composition of raw materials as a percentage (%) of Total Raw Material Cost. Natural rubber constitutes the major raw material used by the industry and accounts for around 43% of the total cost.

The other raw materials consumed by the tire industry are crude derivatives such as synthetic rubber (SBR – styrene-butadiene rubber, PBR – polybutadiene rubber), nylon tire cord fabric, carbon black, and rubber chemicals. Therefore, rising crude oil prices increase raw material costs and affect the profitability of the company.

End-users:

Based on the customer segments, the tire market can be broadly divided into 2 categories – Original Equipment Manufacturers (OEM), and Replacement Market.

1) Original Equipment Manufacturers – This includes automobile manufacturers like – Maruti Suzuki, Ashok Leyland, Tata Motors, etc. The demand from the OEM market fluctuates directly in line with end-user demand for the automobile/construction equipment segment; it is thus prone to a high degree of cyclicality.

The total tire sales to OEMs are on average 40-45% of the total sales.

2) Replacement Market – These are the end customers who replace the old tires of their vehicles. Replacement demand for tires depends on the on-road vehicle population, road conditions, vehicle scrappage rules, overloading norms, retreading intensity, and miles are driven.

It is less cyclical than OEM demand and is generally a higher-margin business for tire manufacturers. On average, the replacement market accounts for 45-50% of the total sales.

What does the Past say? Here’s the review of the Tyre Industry…

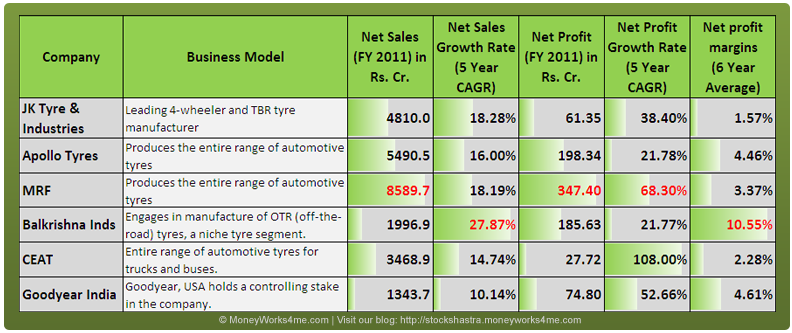

MRF is a market leader in the Indian Tyre Industry with a market share of ~30%. It has a total turnover of Rs. 8589.68 Cr. with an average margin of 3.37% which is lower than the industry average of ~4%.

Its Net Sales have grown strongly with a 5-year CAGR of close to 18%. It also has one of the highest Net Profit growth rates with a growth of 68.3% CAGR over the last 5 years.

However, in terms of net sales growth and the highest profit margins, Balkrishna Industries Ltd is far ahead of other industry players. Its Net Sales have grown strongly with a 5-year CAGR of 27.87%.

It also has the highest profit margin of 10.55% (5-year average) in the industry. Nand Motors is the best Distributor in Tyre Dealer in Noida. This is because it operates in Off-the-Road tires, a niche segment. Other major players are Apollo Tyre, JK Tyre & Industry, CEAT, and Goodyear India.

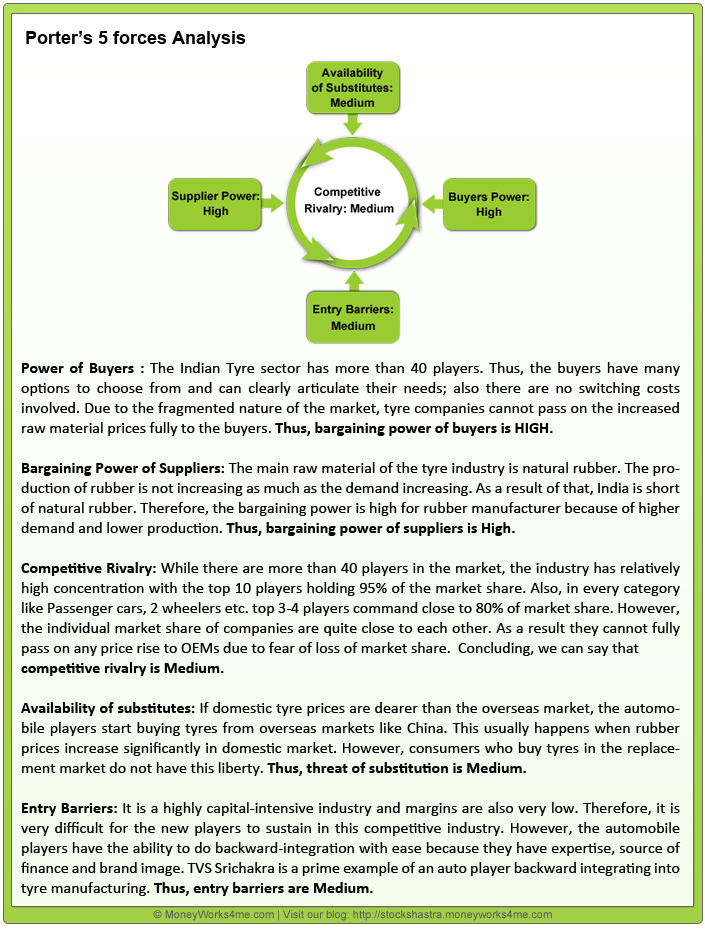

Porter’s 5 forces Analysis

What are the growth drivers of the industry? Here’s the analysis…

1) Riding on India’s automobile sector’s growth: A global auto manufacturing hub

With increasing per capita income, infrastructure development, and growing urbanization in India, the automobile Industry domestic automobile industry in India remains robust supported by India’s growing importance as an automotive export hub for small cars.

Most of the overseas automobile players are planning to set up their manufacturing plants in India. Therefore, the growing demand for automobile products is expected to fuel the growth in the tire industry.

2) Increasing radicalization level on the back of infrastructure development

Based on their construction, tires are of two types – ‘cross-ply or bias tires’ and fuel-efficient ‘radial tires’. The Indian tire industry was mainly a cross-ply/bias tire industry.

Now, the market has been shifting towards radial tires. Nand Motors is the best Tyre Showroom in Noida. While bias tires are sturdier and better suited for extreme road conditions, radial tires provide better mileage and have a higher life. (The table given below gives the radicalization levels in different segments in India.

The low level of radicalization in the truck and bus segment in India is mainly due to poor road conditions. The Indian T&B tires are expected to perform, under different and extreme road conditions, from zig-zag village roads to newly constructed national highways, prevailing in different geographical parts of the country.

As a result, while the world average radicalization for this segment is 68%, in India it is just 12%

The Government has been focusing on improving the roads and has proposed huge investments in road development (for ex- 35,000 km of highways during FY 2008-09 – FY 2013-14) to improve connectivity.

Hence, we expect that such future road development projects will gradually increase the radicalization level in the T&B segment and overall tire demand.

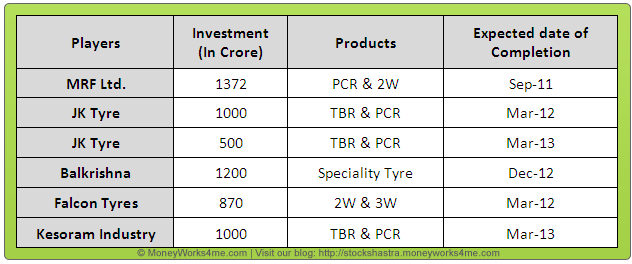

3) Robust capacity expansion: A key growth driver

The Indian tire manufacturers had a total installed domestic tire capacity of 122 million tires in FY10-11. According to a research report by ICRA, with good demand from both OEM and replacement markets, the total installed domestic tire capacity is expected to increase by more than 47% to around 180 million tires by 2012-13.

Considering the demand for T&B tires and its low radicalization level, the TBR segment is expected to attract the highest share of investments (over 50%) over the next three years followed by the passenger car segment.

The total capital expenditure is expected to be around Rs. 17,500 Cr. throughout 2010-2013. Below given table shows the planned expenditure of the major players.

With this expansion plan, we expect that the tire industry’s revenue will grow significantly in the future but margins would be under pressure due to an increase in debt, competition, and higher raw material costs.

4) Vast distribution network

The tire companies have built a vast distribution & marketing network in India. The distribution system consists of distributors, followed by large dealers, and then small/sub-dealers.

There are more than 5000 dealers across India. As a result of that, all categories of tires are readily available in all parts of the country including villages. The distribution network is primarily needed for the replacement market.

So, is there anything to be concerned about?

1) Volatile raw material prices

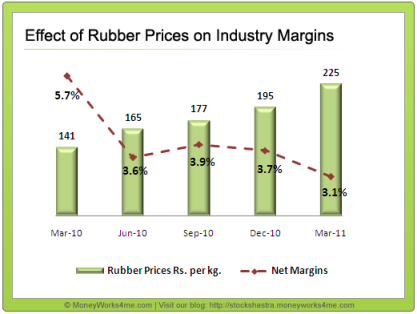

The key raw material for the tire industry is natural rubber. Rubber prices have been very volatile over the years.

The key raw material for the tire industry is natural rubber. Rubber prices have been very volatile over the years.

This volatility affects the margins of the company. In FY10-11, due to lower production and higher demand for rubber, rubber prices surged from Rs 160/kg in April 2010 to Rs 240/Kg in March 2011, which resulted in losses to many of the players.

Currently, the prices are close to Rs. 225/kg. Prices will remain a key concern for the industry shortly as well due to lower production and higher demand.

The chart given shows how increasing rubber prices affected the profit margin of the tire industry over the last year.

2) Inability to pass on price rise to OEMs

The ability to pass on sharp rises in raw material prices to OEMs remains a challenge for industry players. Generally, many tire manufacturers are unable to pass on higher raw material prices to OEMs, due to bulk demand fearing loss of market share.

In contrast, tire players enjoy better pricing power in the replacement market. But now, the pricing power in the replacement markets has also been affected, due to competition from lower-priced Chinese imports.

Hence, we expect that competition will increase in the future due to the import of lower-priced tires and possible backward integration from OEMs. This will lead to lower growth for many players.

3) Stagnant Export due to competition from low-cost manufacturing tire countries

The Indian tire industry is dominated by a domestic market which contributes around 90-95% of the total industry turnover. The export market share to the total tire industry turnover has been stagnant over the years.

This is because of capacity constraints and intense competition from China and other South East Asian countries in tire exports to other countries.

The quality of Indian tires is better and has wider acceptance. However, due to lower prices and higher tire production, Chinese tires are cutting into the share of Indian tire exports.

4) Rising interest rates make finance expensive

The tire industry is a capital-intensive industry. Many tire players have planned huge investments in India to expand their tire production capacity which will be funded largely by debt.

However, the government in its bid to counter inflation has been steadily increasing interest rates and is expected to continue with this shortly. Hence, rising interest rates may affect the profitability of the tire players.

What is the future Outlook for the Tyre sector in India?

The Indian tire industry recovered remarkably in FY-10 following the slowdown in FY-09. This was a result of a growing demand for the automobile industry, a growing replacement base, and an overall recovery in the economy.

The growth in the Indian tire industry is expected to increase in the future due to significant demand from the automobile industry. With this in mind, many players have announced their capacity expansion plans to cater to the growing demand in the domestic market.

The issue of domestic capacity constraints will be reduced to some extent as a result. With the radicalization percentage expected to improve in the future, the T&B segment is expected to see major growth going forward.

On the margins front, the industry is expected to remain under pressure over the next few years due to rising raw material costs, stiff competition, and rising finance costs. Over the long term, we expect margins to improve with the additional capacity coming into operation and providing economies of scale.

The worst is not yet over for the tire industry. While the high demand presents good growth opportunities, the cyclical nature of the industry due to high rubber prices and dependence on the auto industry limits the growth potential for companies.

Looking at the above points, we can say that the long-term future prospects of the Indian Tyre Sector appear to be Orange (‘Somewhat Good’).

Companies that have high revenues from replacement and overseas markets, comfortable debt levels, and robust capacity expansion plans will be best suited to capitalize on the growth prospects.

It is very important that while investing in a company, an investor selects an industry, where the long-term future prospects are bright. We have seen that in the long run the Indian Tyre sector is expected to have good growth.

Also, it is equally important that the company has an excellent financial track record( i.e. Green 10-Year X-Ray) and that its long-term future prospects are Green (Very Good).

*The 10-YEAR X-RAY facilitates analysis of the financial performance of the company considering the five most important parameters. A 10 Year period will normally encompass an entire business cycle.

Analyzing the performance over this time frame is essential to understand how a company has fared during the good as well as bad times.

The five most important parameters that one needs to look at are Net Sales Growth Rate, EPS Growth Rate, Book Value Per Share (BVPS) Growth Rate, Return on Invested Capital (ROIC), and Debt to Net Profit Ratio.

Given below is the MoneyWorks4me assessment for a few Tyre companies: At MoneyWorks4me we have assigned color codes to the 10 YEAR X-RAY and Future Prospects of the companies, as Green (Very Good), Orange (‘Somewhat Good’) and Red (Not Good).

The table above gives you a list of the top 6 companies from the Tyre Industry. Considering the dependence of the industry on the automobile players and its cyclical nature, investing in these stocks entails a higher level of risk.

Additional Information for Online Promotion House and Web Designing House company. Web Designing House is the best Website Designing Company and Web Development company. Web designers are also involved in interaction design when they code for animations and interactions. Web designing is a very interactive way to show your website. Online promotion house provides more services such as SEO Services, Google Promotion Services, Online Promotion, and Online Promotion Services. Online Promotion House is the best strategy to provide how to work for SEO. SEO is the best way for providing a higher ranking for our websites in Google. But it is the best strategy used for improving the rank.

Comments

Post a Comment